Waspadalah terhadap penipu yang aktif di WA mengatasnamakan Indonesia Investments

15 April 2025 (closed)

Jakarta Composite Index (6,441.68) +73.17 +1.15%

A Forecast on Indonesia’s May Trade Balance and June Inflation

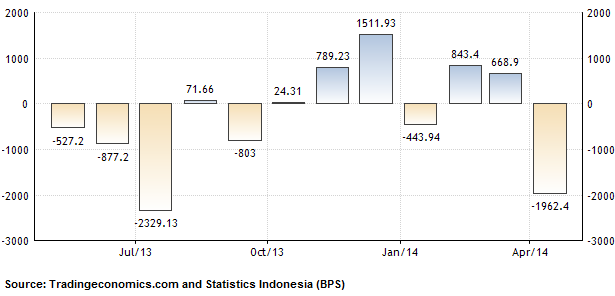

Indonesian Finance Minister Chatib Basri estimates that the trade balance of Indonesia may post an USD $500 million surplus in May 2014 amid improved performance of the country’s crude palm oil (CPO) exports, both in terms of price and volume (crude palm oil being one of the most important foreign exchange earners of Indonesia). Concern about Indonesia’s trade balance (and current account balance) had returned after Indonesia recorded an USD $1.96 billion deficit in the previous month.

Indonesia Balance of Trade (in USD million):

Apart from the improved performance of CPO, the May 2014 trade balance is also expected to be supported by a decline in imports of mobile phones. This decline is the result of the government’s decision not to impose the sales tax on luxury goods (PPnBM) on mobile phones. The discourse about the possible implementation of this tax led to a significant increase of mobile phone imports in April 2014. Recently, Head of Statistics Indonesia (BPS) Suryamin said that mobile phones have become the commodity with the second-largest import value after the oil and gas components. Regarding the non-oil and gas sector, mobile phones have taken the top position (source: official website of Indonesia’s Finance Ministry).

Previously, central bank Governor Agus Martowardojo said that the trade balance is expected to weaken in the second quarter of 2014 (compared to the first quarter). However, it is also a traditional phenomenon that the trade balance weakens in the second quarter as imports increase ahead of the holy fasting month of Ramadan and Idul Fitri festivities. For local companies this is also the moment to engage in business expansion.

However, Bank Indonesia still targets to keep the country’s current account deficit below the three percent of GDP mark in 2014. The bank’s monetary policy is currently primarily aimed at reducing the current account deficit as well as curbing high inflation. Therefore, the central bank has kept its benchmark interest rate (BI rate) at 7.50 percent for eight consecutive months. If the trade balance does not improve in the months ahead then the BI rate will be kept at 7.50 percent (at least) until the end of 2014.

Indonesian Inflation June 2014

Deputy Governor of Bank Indonesia Perry Warjiyo expects the country’s inflation pace to be in the range of 0.3 and 0.5 percent (month to month) in June 2014. A central bank survey indicated that inflation stood at 0.37 percent (mtm) up to the third week of this month. If Warjiyo’s forecast is correct it means that inflation in June 2014 is lower than the historic average in June. However, he stated that inflationary pressures are mounting at the month-end as prices of chicken meat, eggs and rice are on the rise.

On a year-on-year basis, inflation is expected to ease to 6.6 or 6.7 percent in June 2014 (from 7.32 percent in May 2014). In June 2013, inflation reached 1.03 percent, partly inflicted by the impact of the higher subsidized fuel prices.

The Indonesian government targets an inflation rate of 5.3 percent in 2014, while Bank Indonesia kept its target in the (wide) range of 3.5 to 5.5 percent.

Inflation in Indonesia:

| Month | Monthly Growth 2013 |

Monthly Growth 2014 |

| January | 1.03% | 1.07% |

| February | 0.75% | 0.26% |

| March | 0.63% | 0.08% |

| April | -0.10% | -0.02% |

| May | -0.03% | 0.16% |

| June | 1.03% | |

| July | 3.29% | |

| August | 1.12% | |

| September | -0.35% | |

| October | 0.09% | |

| November | 0.12% | |

| December | 0.55% | |

| Total | 8.38% | 1.56% |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Inflation (annual percent change) |

9.8 | 4.8 | 5.1 | 5.4 | 4.3 | 8.4 |

Source: Statistics Indonesia

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini