Be aware that there are scammers active on WA pretending to be Indonesia Investments

21 April 2025 (closed)

Jakarta Composite Index (6,445.97) +7.70 +0.12%

Bank Indonesia Keeps Key Interest Rate (BI Rate) at 7.50% in July 2014

The central bank of Indonesia (Bank Indonesia) decided to keep its benchmark interest rate (BI rate) at 7.50 percent at today’s Board of Governor’s meeting. The lending facility as well as deposit facility were maintained at 7.50 and 5.75 percent, respectively. The central bank believes that the current interest rate environment is able to push the inflation figure back to its target range of between 3.5 and 5.5 percent by the year-end. Earlier this month, Statistics Indonesia announced that inflation has eased to 6.70 percent (year-on-year) in June 2014.

Inflation in Indonesia:

| Month | Monthly Growth 2013 |

Monthly Growth 2014 |

| January | 1.03% | 1.07% |

| February | 0.75% | 0.26% |

| March | 0.63% | 0.08% |

| April | -0.10% | -0.02% |

| May | -0.03% | 0.16% |

| June | 1.03% | 0.43% |

| July | 3.29% | |

| August | 1.12% | |

| September | -0.35% | |

| October | 0.09% | |

| November | 0.12% | |

| December | 0.55% | |

| Total | 8.38% | 1.99% |

| Inflation Rate June 2014 |

Inflation Rate Calender 2014 |

Inflation Rate year-on-year |

|

| General | 0.43 | 1.99 | 6.70 |

| - Core | 0.25 | 1.88 | 4.81 |

| - Administered Price | 0.45 | 2.37 | 13.47 |

| - Volatile | 1.06 | 2.22 | 6.74 |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Inflation (annual percent change) |

9.8 | 4.8 | 5.1 | 5.4 | 4.3 | 8.4 |

Source: Statistics Indonesia

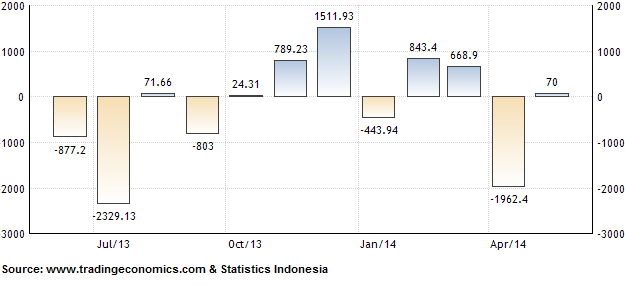

Furthermore, the maintained interest rate environment is expected to have a positive impact on the country’s current account balance. Since 2011, Southeast Asia’s largest economy has had to cope with a serious current account deficit (which is a sign of weakness in the eyes of investors). The latest released trade data show a USD $69.9 million trade surplus in May 2014, after a disappointing USD $1.96 billion deficit in the previous month.

Indonesia Balance of Trade (in million US dollar):

Later today, an in-depth article about Bank Indonesia’s stance on economic developments in Indonesia will be published.