Be aware that there are scammers active on WA pretending to be Indonesia Investments

10 April 2025 (closed)

Jakarta Composite Index (6,254.02) +286.04 +4.79%

Update Indonesia's Current Account Deficit and Foreign Exchange Reserves

Indonesian Finance Minister Chatib Basri said that the country's current account deficit, the broadest measure of international transactions, may widen in the second quarter of 2014 as many local companies engage in business expansion. Such expansion usually triggers an increased amount of imports, thus impacting on the trade balance. A widening current account deficit in the second quarter of the year is a normal trend. The balance usually improves in the third and fourth quarters.

Basri is still optimistic that Indonesia's current account deficit can be kept at 3 percent of the country's gross domestic product (GDP) in 2014. He expects a small trade surplus in April 2014. Political turmoil in Thailand will result in declining exports to Thailand.

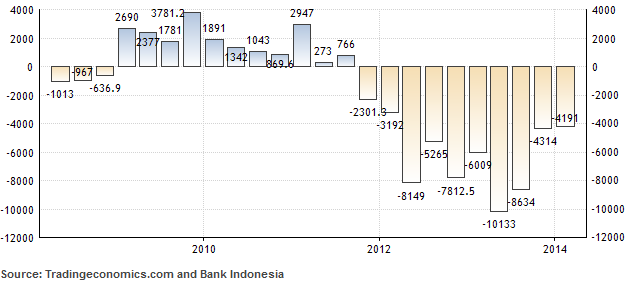

The current account deficit of Southeast Asia's largest economy has been a major concern to the investor community since 2012 when the deficit started to become structural. In the second quarter of 2013 the deficit reached a record high of USD $10.1 billion (or 4.4 percent of GDP). Amid the looming end of the Federal Reserve's quantitative easing program, it led to large capital outflows from May 2013 up to the end of the year. One of the consequences was that the Indonesian rupiah exchange rate lost about 26 percent of its value against the US dollar in 2013. Moreover, Indonesia became known as one of the fragile five.

However, the government and central bank have implemented a number of fiscal policy packages (for example a number of tax measures) that aimed to boost the country's exports while curbing imports. Meanwhile, the sharply depreciated rupiah exchange rate made Indonesian exports highly competitive on the international market. This has resulted in an improved current account balance ever since Q2-2013. The current account deficit fell from USD $4.3 billion (2.12 percent of GDP) in the fourth quarter of 2013 to USD $4.2 billion (2.06 percent of GDP) in Q1-2014.

Current Account of Indonesia (USD million)

Meanwhile, the central bank of Indonesia (Bank Indonesia) said that it expects its foreign exchange reserves to remain stable for the remainder of the year, possibly growing slightly. Executive Director of Foreign Exchange Management at Bank Indonesia Budianto said that the appreciating rupiah exchange rate in 2014 supports the higher foreign exchange reserves. Moreover, economic fundamentals of Indonesia have been stable with the current account deficit and high inflation gradually easing. At the end of April 2014, the foreign exchange reserves at Bank Indonesia amounted to USD $105.6 billion.

Indonesia's Foreign Exchange Reserves 2008-2014:

| 2008 | 2009 |

2010 | 2011 | 2012 | 2013 | 2014² | |

| Foreign Exchange Reserves¹ |

51.6 | 66.1 | 96.2 | 110.1 | 112.8 | 99.4 | 105.6 |

¹ in billion US dollar

² at end April 2014

Source: Bank Indonesia